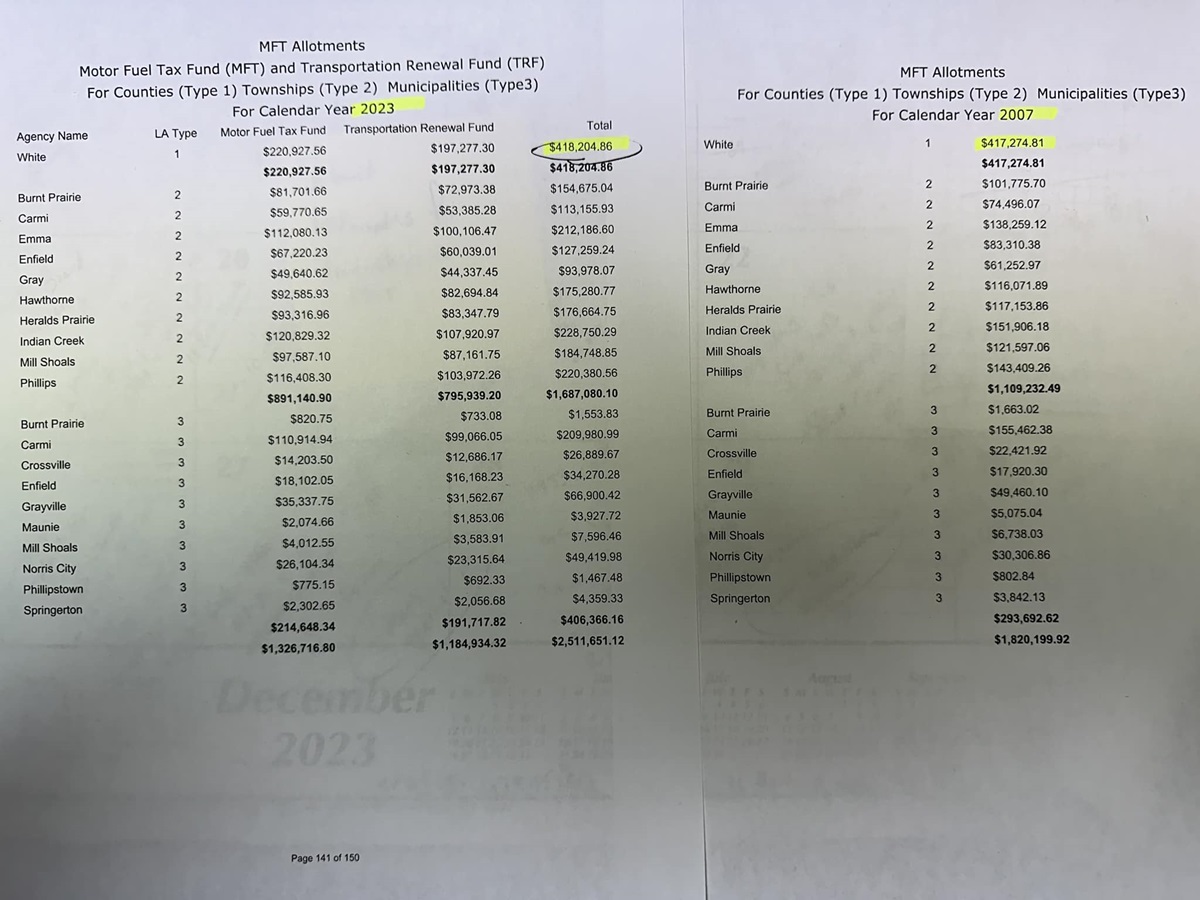

With 164 miles of roadway to upkeep and the price of material skyrocketing, it’s a challenging time for White County Highway Engineer Brian Ray. He took to social media recently to show a Motor Fuel Tax funding comparison from 2007 and 2023. It’s essentially flat. In 2007, the county’s portion of MFT funds was just over $417,000. In 2023, the county received just $930 more. He called the MFT money the lifeline to repair county roads.

When you take into account those Motor Fuel Tax funds were raised significantly just a few years ago, it adds a layer of confusion as to where that money is being allocated.

“In 2019, they doubled the Motor Fuel Tax. It went from 19 cents a gallon where it had been since 1990. So we should see a revenue increase but our numbers are essentially the same. Everybody else has seen an increase. Every township has seen an increase. Township combined numbers went from $1.1 million to $1.6million. Same thing with cities and villages. Their revenue is up by almost 25%…$293,000 to $406,000. But doubling that fuel tax and we’ve seen hardly anything.”

That disparity and lack of expected revenue growth has Ray diving deeper into the numbers looking for the why and where. His desk and computer are stacked as he’s building spreadsheets and graphs to find out what his county’s collar and statewide counties are gaining (or losing).

It’s a complex formula. City allocations of funding are based on population. Township funds are calculated by how many miles of roadway have to be maintained. County money is based on vehicle registrations. Even though vehicle registrations in the county have gone down over the last 16 years, Ray believes doubling that Motor Fuel Tax should more than make up for any losses.

“White County registrations were 21,650 in ’07. By 2023, they went down to 19,119, down by 12%. In the meantime, they’ve doubled the Motor Fuel Tax, but it equates to basically no increase for us.”

Ray thinks some of that money the state could be delivering to transit, most likely railways. Some counties are seeing increases. Ray says Saline County is down 7.5% but their funding increased 16%. Wabash registrations went down 5%, but revenue is up 21%.

“You would think if it was tied to registrations alone, there would be some consistency. But there’s not. Some counties are gaining registrations and gaining a bunch of money. Others are losing registrations and still gaining money. There’s numbers everywhere and it’s too convoluted for anybody to understand.”

In the meantime, Ray and county workers will continue to do their best on county roads. He says contacting legislators to ask them to look at the numbers and make them see just how bad the situation is. He’s also asking for understanding as to why the conditions of county roads continue to deteriorate.